MCRA Advisory Paper | September 12, 2022

Authored by Daniele Chenal (Inspire Innovations), MCRA Operations Committee Chair

EXECUTIVE SUMMARY

While many Medicare Advantage health plans enjoyed high Centers for Medicare and Medicaid services (CMS) Star Ratings in 2022, due to several factors including a grace period afforded by COVID-19, the ratings were over-inflated and we anticipate a drop in performance scores in 2023 and beyond. For many plans this will be a set-back and will negatively impact projected enrollment and revenue. Plans must set a course that includes improving member engagement, becoming member-centric and optimizing administrative processes to outperform prior years’ performance.

The CMS Star Ratings Program

The Centers for Medicare and Medicaid services (CMS) started the 5-Star Rating system (program) for Medicare Advantage Health Plans in 2008. The program uses clinical quality data and consumer and health outcome survey data to rate Medicare Advantage Plans on a scale of 1 to 5. The program was designed to aid beneficiaries in comparing health plans, drive transparency and increase the quality of care provided to plan members.

BENEFITS FOR HEALTH PLANS

Health plans are incentivized to achieve the highest Star Ratings to increase Plan enrollment and grow revenues. Benefits include:

Special 5-Star enrollment period allowing plans to market and enroll new members all year.

5% bonus payments (on top of county adjusted rates paid to plans by CMS for each enrolled member) for plans with ratings of 4, 4.5 or 5-Stars.

5% rebates that plans reinvest in member benefits making their supplemental benefits more attractive to enrollees.

5-Star Ratings displayed on websites and used in marketing.

New Barriers to 5-Star Ratings

CMS Star Rating measures for both Part C and Part D and are organized into multiple domains. Measures are further divided in multiple categories. The first change in CMS’s Star program is a shift in the weighting of customer (member) experience measures.

Domain 3 is predominantly made up of measures from the Consumer Assessment of Healthcare Providers and Systems (CAHPS). Measures include getting needed care and prescription drugs, getting appointments and care quickly, customer service, rating of the health plan, rating of care quality and care coordination.

Clinical quality had historically been a key differentiator between high-performing and low-performing plans, however over the past few years CMS has put increasing emphasis on member experience. In 2019, only 34% of the overall score was based on Customer (Member) Experience and Administrative measures.

Starting in 2023, Customer (Member) Experience and Administrative measures will make up 56% of the overall score with customer experience (CAHPS) contributing 32%.

A statistic that should be concerning to health plans is that based on 2022 performance data, 62% of all plans (contracts) scored lower than 4-Stars in Domain 3 and of those, 50% scored lower than a 3-Star. Plans with scores lower than a 3 will not be able to achieve a 4-Star rating without improving their CAHPS scores. Similarly, those plans with scores lower than 4 will not be able to achieve a 5-Star rating without improvement in CAHPS.

Based on the draft 2023 cut-points updated 9/1/2022, many of the CAHPS cut points have gotten somewhat easier however, the increase in weighting and historical plan performance still presents a significant challenge. And, for some scores while they may not have increased in 2023, they remain unchanged from the increases in 2022, for example rating of the Health Plan wherein a score of 87% would have been a 4-Star in 2020 but only a 3-Star in 2022 and 2023. Additionally, for some measures they have increased in both 2022 and 2023.

You can see in the following tables that the pressure for improvement is especially pronounced for measures that have both a more difficult cut-point hurdle paired with an increased score weighting to boot.

The above means that plans will need to work quickly to identify root causes of both member and provider dissatisfaction, improve member communication and engagement and make member experience an integral part of the organizations DNA.

Performance Measures and Weight Changes

Table 1 below lists the performance measures and illustrates the measures with a change in weighting.

Table 1: HEDIS - Heath Effectiveness and Information Data Set, HOS - Health Outcomes Survey, PDE - Prescription Drug Event

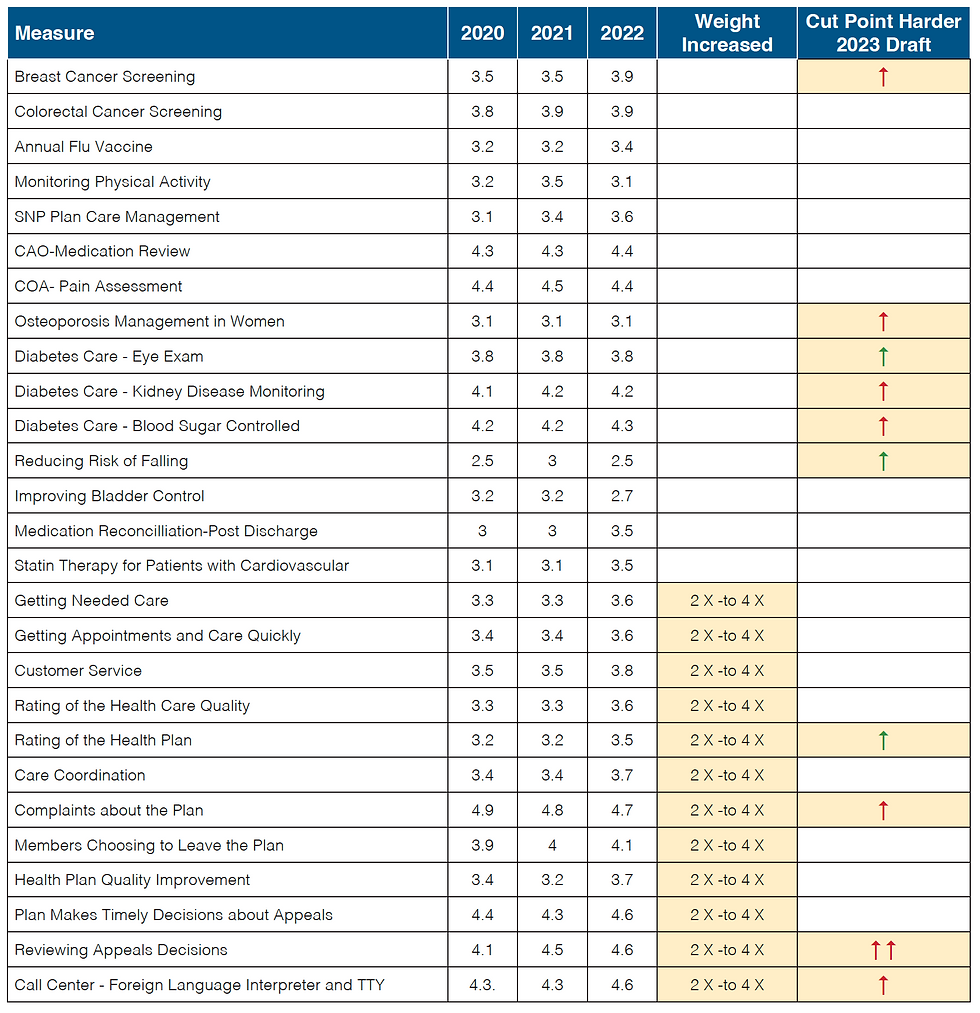

Tables 2, 3 and 4 below show the average Star Ratings for health plans from 2020 to 2022. Those more difficult measures that have increased weightings and/or cut-points boundary increases have been highlighted.

Table 2: Average Star Ratings by Measure Year over Year - MA Plans

Table 3: Average Star Ratings by Measure Year over Year - MAPD Plans

Table 4: Average Star Ratings by Measure Year over Year - PDP Plans

Boosting Star Ratings Performance for 2024 and Beyond

STRATEGIES FOR SUCCESS

It should be clear that customer (member) experience must be central to a plans strategy to achieve 4+ Star Ratings and plans must view member experience in the context of the entire member lifecycle. Considering CAHPS and administrative measures now make up 56% of the total score, plans should focus on programs and initiatives that both drive member-centric service while maintaining clinical quality outcomes.

Here are 6 key strategies to consider:

Leveraging and augmenting data assets to understand the root cause of both member and provider dissatisfaction to aid in prioritizing effective improvement strategies and measure results.

Rewarding employees to drive a customer service centric culture.

Improving provider satisfaction and strengthen provider networks.

Embracing innovative technologies that improve administrative processes, enhance customer service, improve data consolidation and analysis.

Adopting tools, techniques and partners that can drive member engagement and personalize communication

Establishing new partnerships to enhance care coordination.

Of course, in addition to initiatives to improve CAHPS and optimize administrative processes, plans must continue to sustain high performance in clinical quality outcomes and leverage personalization, effective member communications and coordination of care to close the GAP on challenging Healthcare Effectiveness Data and Information Sets (HEDIS) and Health Outcome Survey (HOS) measures. Consistent with CMS’ meaningful measures, there is a high priority for quality measurement and improvement, with the goal of improving health outcomes for members, their families, and measured entities, including health plans.

Who We Are

MCRA is a unique industry alliance of senior consultants, specialty service and technology providers collaborating to bring comprehensive solutions to solve complex industry challenges. We work with health plans, delegates, and clinical vendors large and small to implement processes, programs and technologies that drive optimal performance. Our focus is to provide health plans with a singular, best in class resource to support all areas of a managed care organizations challenges.

Our members provide solutions along the entire value chain of a health plan, and we service over 200 health plans in Medicare, Medicaid, commercial and self insurance.

How We Can Help

We can help by evaluating your current performance scores and working with your team to assess where you may need help in implementing the six key strategies outlined. Our members collectively address the many facets of the Star Ratings performance measures from improving access to care and care coordination, improving Complaints, Appeals and Grievance handling, engaging members to close the gaps on HEDIS/HOS measures and many other solutions that result in reduced complaints, improved CAHPS scores and better overall performance.

Based on your needs we can assemble the right capabilities from our portfolio of member solutions which include:

Employee and Member Reward Programs

Provider Network Development

Provider Directory Services

Concierge, Navigation and Advocacy Services

Mental Health Matching/Referral Services

Home/Vehicle and other Safety Modifications services

Call Center and Communications Services

Print, Mail and Document Services

Personalized Member Engagement

Online learning and socialization Solutions

Complaint, Appeals and Grievance Case Management

Authorization Intake Automation

Data Augmentation, Cleansing & Root Cause Analysis Services

Back Office, Compliance and Business Process Outsourcing

Industry Expertise/Consulting

Comments